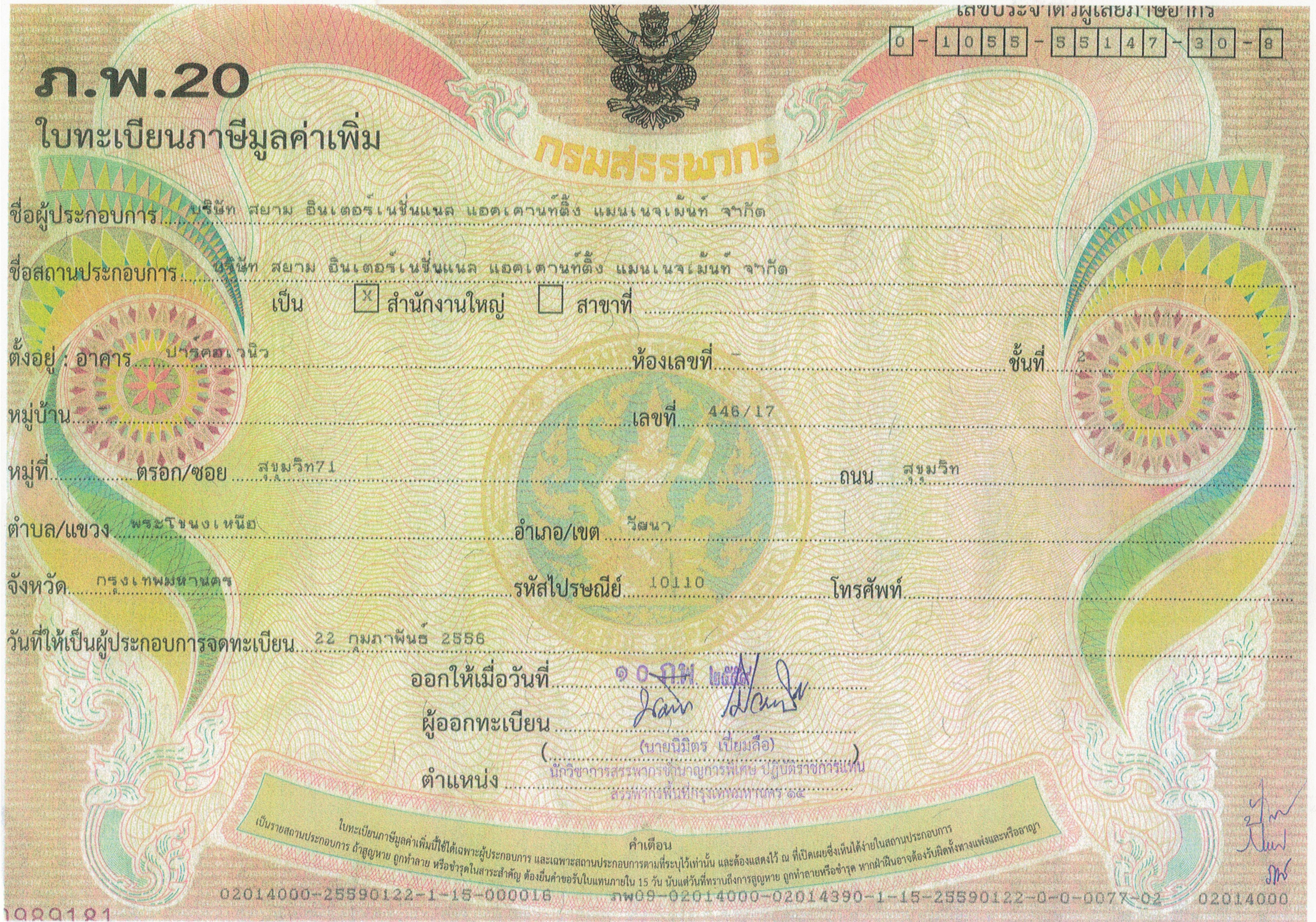

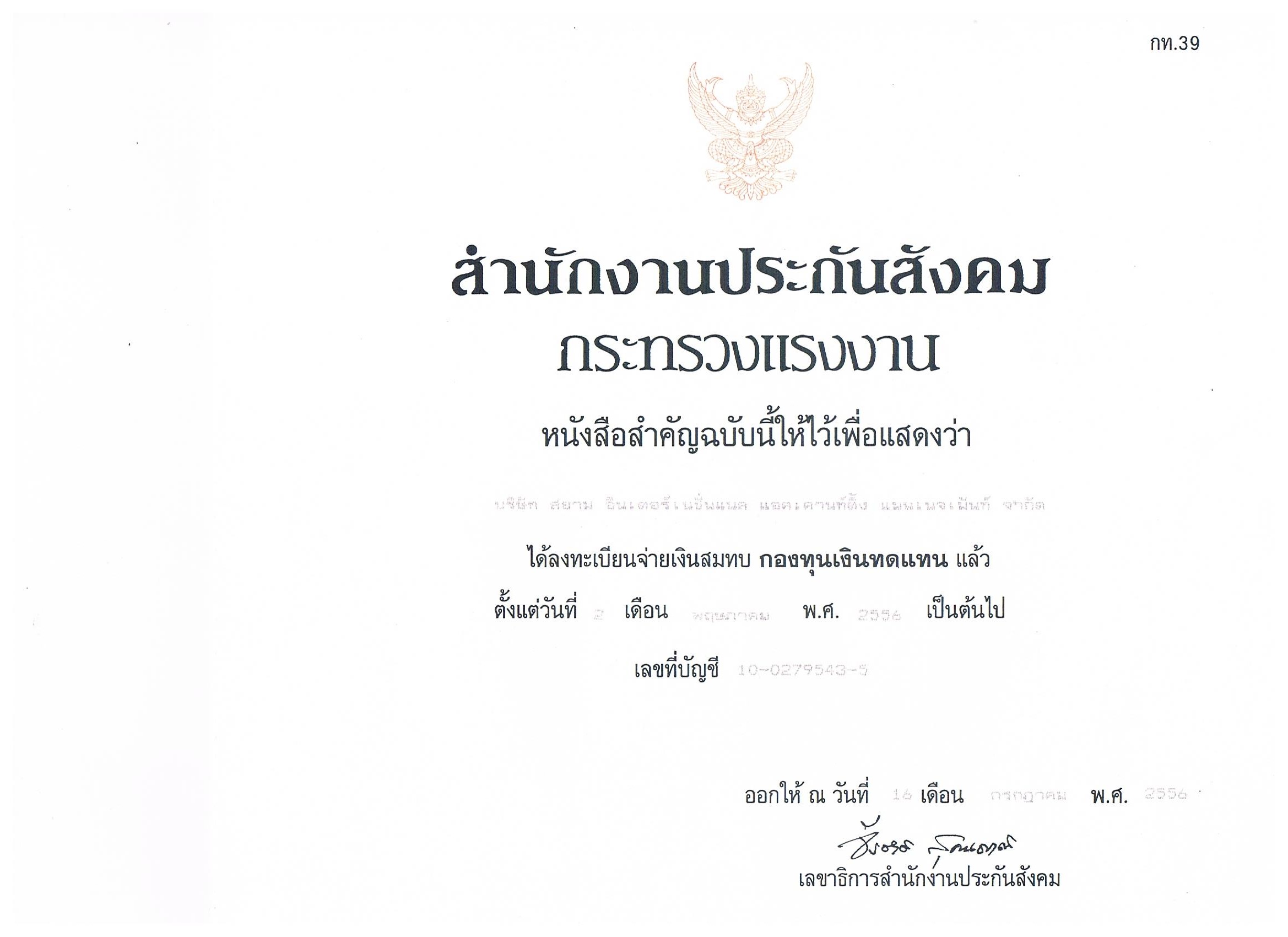

Siam International Accounting Management Ltd.

Based in Bangkok, Thailand, we provide specialist international taxation advice. Whilst our local competitors strive to be "pretty good" at all manner of legal issues including visa services, business advice, taxation, divorce law, property law, civil disputes, and such, we are taxation specialists and consequently have the most successful track record in Thailand for presenting tax treaty claims for international teachers. The Director's role primarily involves provision of advice and making strategic decisions as to which issues we will work on, and consequently part of his work involves reinterpreting what has come before as a way to develop a line of sight into what comes next. With fifty-two years of international taxation experience, including twenty years handling tax treaty issues in Thailand, the Director, Stephen Dann is able to draw upon his considerable experience in this type of work and ensures that the company's priorities and practices stay consistent in good times and bad. With Revenue Department staff, who are poorly trained and ill-equipped, problems frequently arise and Stephen regularly has to focus his attention on individual cases in order to resolve claims, whilst the company's four Thai staff attend to the more predictable day-to-day administrative issues. We make extensive use of "If-Then" plans, which have been developed from years of experience, to ensure staff know what to do in given situations, without the need to seek the Director's advice.

With more than one thousand successful claims the staff now have sixty years' combined experience and knowledge of teachers' tax treaty claims, a level of experience that no other company has, and without this level of expertise to hand, competitor firms, for whom teachers' tax treaty claims are non-core business, soon run into difficulty. Stephen is also constantly looking for ways to hone the company's existing capabilities to improve upon a service that is already better than the competition. It is common for competitor companies, who are usually no more than visa mills, to underestimate the complexity of tax treaty work, and whilst they may enjoy early success with a small number of simple cases, for which they charge remarkably modest fees, such firms eventually experience difficulties they never imagined, and teachers are often left without a refund or even an explanation. We take pride in what we do, and also in what we do not do, and whilst we have considerable expertise in handling tax treaty claims, and take pride in this work, we do not dabble in any other legal issues with which we are not entirely familiar.

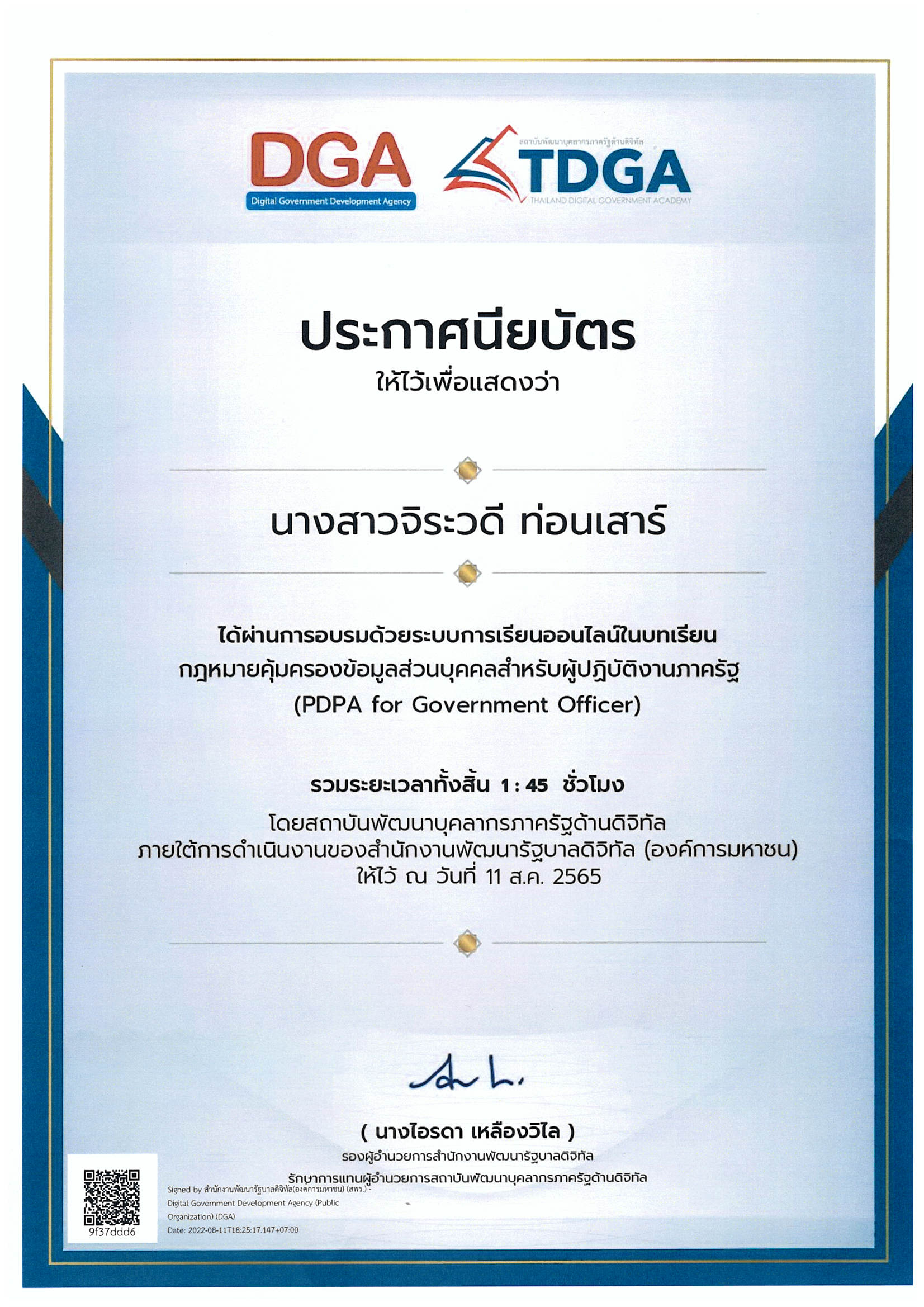

The early years of this company were characterised by a form of "fire fighting" in which managing was a constant act of juggling where to allocate limited time and resources, so there was rarely enough time to resolve every problem that arose and frequently minor problems had to be ignored. Today, the company manager has thirteen years' experience handling and resolving administrative issues directly with the Revenue Department and the banking executive has ten years' experience of resolving issues related to the transfer of teacher-client funds directly with the Revenue Department's bankers. Both of these staff have complete discretion to solve problems on their own. This, together with a comprehensive database, managed by the same employee for the past seven years, frees time to deal with issues involving interpretation of treaties and in this regard the company now employs a Thai lawyer to assist and advise on procedural matters. Over time, staff job descriptions have gradually been reverse-engineered so as to allocate work according to each employee's personal traits, thereby enhancing job satisfaction, staff retention, and company efficiency.

Stephen has built this company from the bottom up, hiring only fully formed adults who put the company's interests first, and who understand and support the desire for a high-performance workplace. If people fail to display this level of adult-like commitment then it is preferable to let them go rather than devise rules and policies to deal with the problems they might cause. The staff are people who want the company to succeed, and can competently manage themselves through common-sense without formal policies. Every employee understands how their performance affects the client, they each benefit from a modest bonus structure related to their individual performance, and as a small team they are efficient and far less frustrating to manage than either the cumbersome groups found in larger international firms, or the whirlpool of inexperienced, disinterested amateurs employed by low-paying local competitors suffering from low morale and consequent high staff turnover.

We believe in the concept of Conscious Capitalism

, which means that in addition to providing a service to our clients, we expect the companies we buy from to receive fair value for their products and services, and to have the least possible impact upon the environment. We recognise that one of the most important factors determining an employee's engagement is the sense that he or she is being recognised, primarily through pay, and that quality of service depends upon retaining experienced staff who feel sufficiently rewarded and contented that the Director does not need to devote valuable time and resources searching for and training replacements. Retaining experienced staff enables Stephen to take a "hands off" management approach, allowing employees to work on their own initiative, merely flagging areas where intervention is needed. There are no procrastinators among the staff and assignments are often completed ahead of schedule.

With the right staff in place Stephen has worked to give them better skills. This has created loyalty and, in turn, a longer life for the company. As a small team the staff require little effort to co-ordinate and will work together to get the job done. They know they have the Director's full support and accept his way of working. We are not in business to provide a "me too" service; the aim is to be better, not cheaper, and we will not cut costs and quality of service in order to obtain business. Those companies that are competing, in a race to the bottom, on cost alone, can only do so by providing an inferior service and the more they cut fees to compete the greater the difference between their service and ours. The few rival companies offering a tax-treaty service display websites that are out of date, one by more than ten years. Tax treaties are sometimes updated (as with India, and the Philippines in recent years). New treaties come into force (Cambodia in 2017) and other treaties are replaced (Singapore in 2017). It is important that an advisor keeps up to date with the treaty network and Revenue Department interpretation, rather than attempting to manage problems retrospectively. Additionally, as both director and principal investor in the company Stephen ensures that the company invests in resources that are of direct benefit to the company's principal activities and not in assets or activities unrelated to the core business. The addition of a computerised database has saved every staff member time, making the company more efficient and enabling it to grow.

International teachers visiting Thailand can usually reclaim their Thai personal income tax at the end of their contract, often providing teachers with a safety net by helping to fill the void between contracts. For more information please visit the dedicated section on this website by clicking the link below.

German Tax Advice

|

UK Tax Advice

|

US Tax Advice

|