Siam International Accounting Management Ltd.

In the past eighteen years we have obtained tax refunds of ThB 372,363,988 from the Revenue Department of Thailand for 1007 teachers of various nationalities including Australian, American, British, and Canadian using the tax exemption granted in many tax treaties. Stephen is the author of this article on the Ajarn.com website for teachers in Thailand:

If you lived in China before teaching in Thailand, your original school contract was for no more than three years (regardless of the subject),

and that initial school contract covered any of the years 2021, 2022, or 2023 you are probably entitled to

claim of all your Thai income tax back by virtue of the Double Taxation Agreement between Thailand and China.

Many countries have such agreements, but eligibility to claim depends upon where you were resident prior to working at a school in Thailand, not upon your nationality. The Chinese agreement, for example, exempts individuals of any nationality who were resident in China before commencing their first teaching contract at a school in Thailand. The teacher does not need to be Chinese, but to have been a Chinese resident. The Chinese agreement only exempts Chinese teachers if they were resident in China immediately before visiting Thailand to teach, and any Chinese teachers who were living in other countries should refer to the agreements with those other countries.

If you are uncertain as to whether you are eligible to claim your tax back please contact us using the email facility on this page for an appraisal.

In order that we may review your situation we simply require a copy of your school contract and answers to some simple questions.

Where tax refunds are possible we can prepare and submit claims on your behalf, and the tax refunds will be wired direct to your bank account overseas once we receive your tax reimbursement from the Revenue Department.

With the consent of all concerned, we are prepared to conduct shared meetings with groups of teachers which saves us repeating the same information to each individual, and which also benefits everyone at the meeting through listening to colleagues' questions and reactions. As a result everyone becomes more knowledgeable about the process.

Determining whether someone is eligible to claim a tax refund is only part of the process, and as with many aspects of life it is not what you do that determines whether a claim is successful, but the way that you do it. Anyone who thinks they are simply going to hand a form in to the Revenue Department and receive a cheque with ease will be very disappointed. There is considerable prejudice directed against these claims and in some instances school administrators will collaborate with Revenue Department officers in order to mislead and confuse teachers so as to prevent them from claiming a tax repayment.

School Directors, often concerned to retain staff, sometimes dissuade teachers from filing a claim by maintaining they will have to pay tax in their home country if they claim a tax refund from Thailand. The teachers' tax exemption is contained within Double Taxation Agreements for a very good reason and by combining the treaty exemption with the residency rules of a teacher's home country it is possible for teachers to have their tax refunded from Thailand and pay no tax in their home country.

In order to assist with routine issues such as completion of forms in Thai, interpretation at meetings, and predictable day-to-day business we employ excellent Thai staff and use very precise technical translation facilities. The Director's role is primarily that of direct contact with the client and resolution of strategic issues such as challenging the Revenue Department's interpretation of legislation. We are the premier company in this field, operating now in "blue ocean" having left the sharks, amateurs and scammers fighting over the scraps left in very deep red sea of their own making. Every year there are additions to our service which extend the distance between us and the competition. If you are considering a rival company, try to establish how many staff they have who are experienced in this work, and what happens if they leave. Will they even respond to emails in English after you have left Thailand?

If we consider that a successful double taxation treaty claim is possible, the fee will be agreed in advance, and will depend upon the dates you worked, the school involved and the availability of documents. We usually request payment of ThB 20,000 plus Thai VAT (currently ThB 1,400) before commencing a claim, and then for payment of any balance of fees once the refund cheque has arrived.

Tax refund claims submitted now should take between three months and, exceptionally, two years from filing with the Revenue Department to the date of payment.

During this time you may view general notices about the progress of your tax refund via our Facebook page where you will find many teachers linked to us and you will promptly realise this is not a scam. In the age of Facebook, Wikileaks, and Twitter companies are better off telling people the truth which, in turn, respects employees' need to know what is really going on so that they can do their jobs. Our staff are all connected to the company Facebook page.

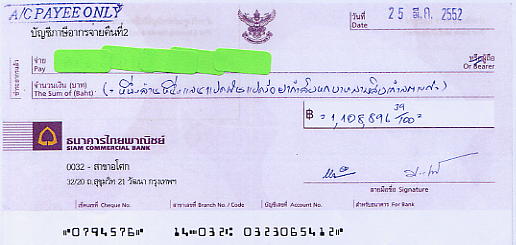

A successful claim (click image to enlarge)

Claims under this agreement are the most complex, and we need teachers to contact us promptly once a commitment is made to leave the present school. We may decline claims that are presented to us late and for teachers who commenced teaching in Thailand during 2022 we will not accept claims after 28th February, 2025.

Thailand/China Double Tax Agreement - Teachers' Tax Exemption

FOR TEACHERS LIVING IN THAILAND AND WORLDWIDE

It should be noted that we are specialist tax advisors, and we do not become involved in other kinds of work; we do not need to. A number of visa lawyers have attempted to process claims without fully appreciating the implications, or the manner in which tax treaty claims in Thailand interact with the tax system of other countries. It would be fair to say that people who hand something as complex as an international tax treaty claim to a mediocre firm of Thai lawyers are unlikely to receive any tax reimbursement, whereas a specialist team will make it work. We have become attuned to signs that a school isn't honouring its commitments, or that tax department officials are putting up too many obstacles, and we have established methods of handling these situations. Visa lawyers are merely looking for "easy" business by providing a minimal acceptable standard of service and attempting to attract clients with lower fees, resulting in a race to the bottom which leaves no margin for resolving the obstacles which frequently arise. Tax refunds are dependent upon highly ambiguous factors, such as the definition of a "visit" or "residence", and getting to the right answer can often involve some tough negotiations. Our philosophy is best described as "better before cheaper" and it would serve their interests better if other companies concentrated on improving their performance in their core business, rather than looking for easy money from something they don't understand.

View testimonials on Linkedin:

![]()

![]()

.

When you have a copy of your contract to hand please send it to us using the email facility below,