Siam International Accounting Management Ltd.

|

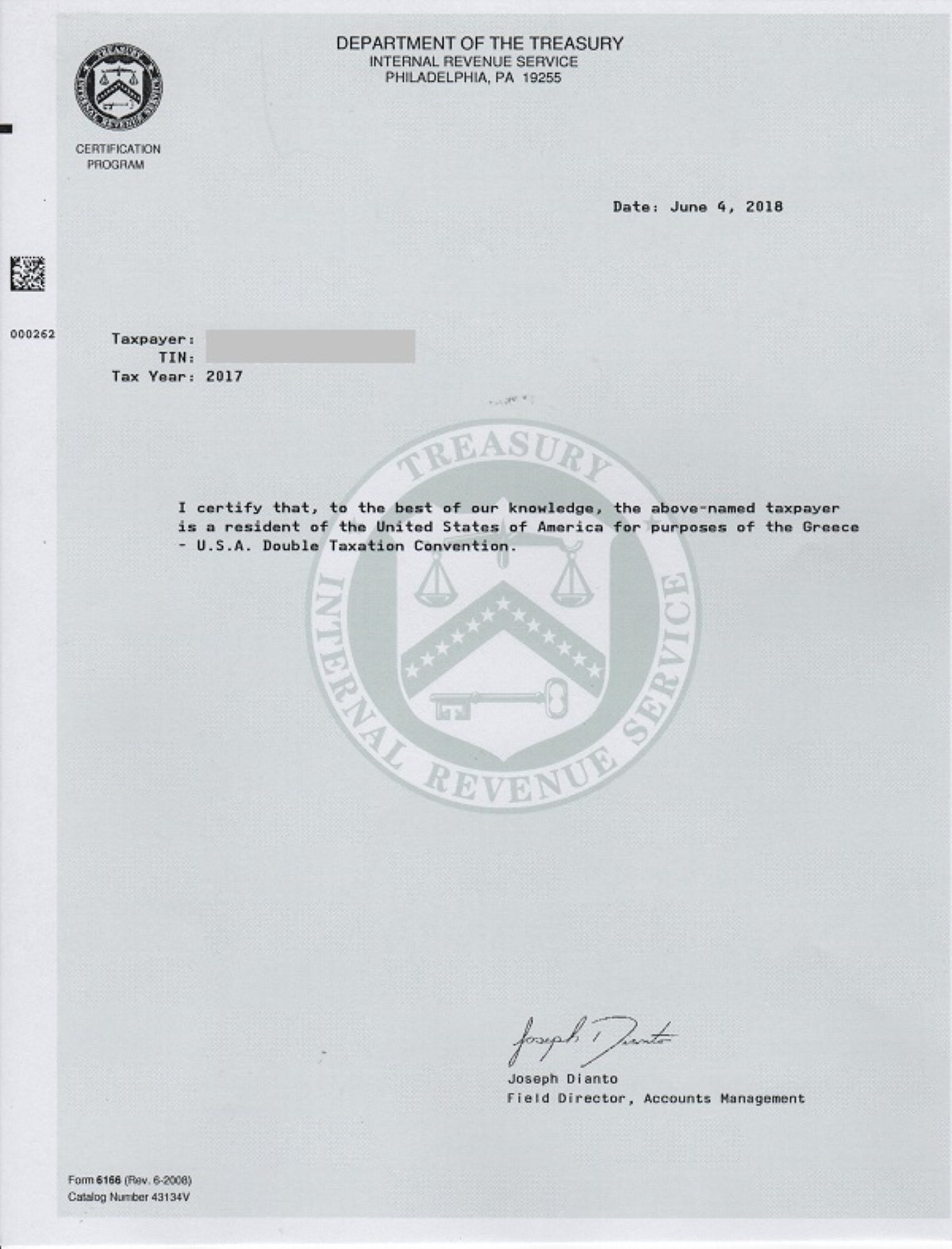

Residency Certificate 6166 |

(click image to enlarge) |

ARTICLE 23 of the Double Taxation Agreement between Thailand and the US provides an exemption from Thai personal income tax for teachers who were resident in the US immediately before visiting Thailand to teach.

Article 23 (1) - Teachers

In determining residency there is worldwide consensus that, if a person is physically present in a country for 183 days or more in a particular tax year, they are a resident of that country. The US, however, uses a variation of the 183-day rule known as the "Substantial Presence Test" which applies a form of weighted average over a three-year period in order to determine the 183 days. It is therefore possible for a person to be considered a US resident under the Substantial Presence test and for the person to also be considered a resident of a foreign country for the same year. This is known as "Dual Residency" which is covered further down this page

THE SUBSTANTIAL PRESENCE TEST

1) The number of days they were present in the US during the current calendar year;

2) One-third the number of days they were present in the US during the previous calendar year;

3) One-sixth the number of days they were present in the US during the second previous calendar year THE BONA FIDE RESIDENCE TEST

THE PHYSICAL PRESENCE TEST

DUAL RESIDENCY

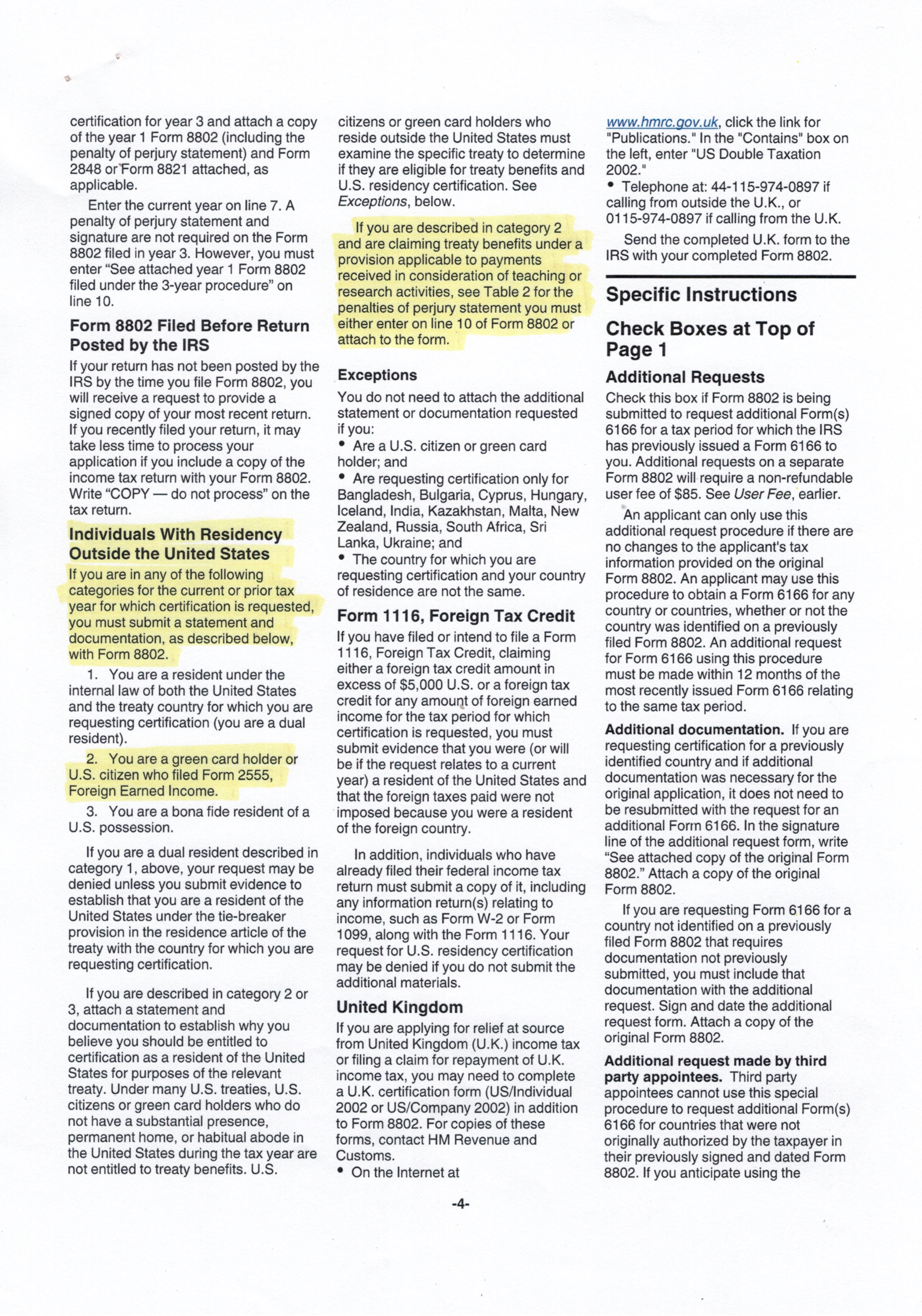

Form 8802 Instructions (Click images to enlarge) Teachers' instructions

a) he shall be deemed to be a resident of the State in which he

has a permanent home available to him; if he has a

permanent home available to him in both States, he shall be

deemed to be a resident of the State with which his personal

and economic relations are closer (center of vital interests);

b) if the State in which he has his center of vital interests cannot

be determined, or if he does not have a permanent home

available to him in either State, he shall be deemed to be a

resident of the State in which he has an habitual abode;

c) if he has an habitual abode in both States or in neither of

them, he shall be deemed to be a resident of the State of

which he is a national;

d) if he is a national of both States or of neither of them, the

competent authorities of the Contracting States shall settle

the question by mutual agreement."

" An individual who visits a Contracting State for a period not exceeding two years for the

purposes of teaching or engaging in research at a university, college or other recognized

educational institution in that State, and who was immediately before that visit a resident of the

other Contracting State, shall be exempted from tax by the first-mentioned Contracting State on

any remuneration for such teaching or research for a period not exceeding two years from the date

he first visits that State for such purpose."

This test looks at a teacher's US presence over a three-year period and deems a teacher to be resident in a particular

calendar year if the sum of the following equals 183 days or more:

In addition the teacher must have spent at least 31 days in the United States in the current calendar year.

It is therefore possible to obtain a form 6166 Residency Certificate having spent little more than one month in the US

during the year immediately preceding the teaching visit to Thailand and claims have been made to the Revenue

Department of Thailand for exemption from Thai personal income tax on the basis that the teacher was a US resident

immediately before that visit, using the 6166 certificate as proof of this, but this relies upon making an incomplete

application to the IRS on form 8802.

This test should not be confused with the tests used to determine residency for the purposes of the Foreign Earned Income Exclusion.

These are:

This determines a person to be a resident of a foreign country if that person resides in that foreign country for "an uninterrupted period that includes an entire tax year".

A person is considered physically present in a foreign country if they reside in that country for at least 330 full days in any consecutive twelve-month period. This is sometimes taken to mean that a person is regarded as US resident if that person is physically present in the US for 35 (365- 330) days. In this regard I recommend reading the Tax Court of Canada case below. As with the Bona Fide Residence Test, this test is only intended to establish foreign residency for the purposes of the Foreign Earned income Exclusion; it has no function for the purposes of double taxation.

US citizens may obtain a certificate number 6166 from the IRS to certify their US residency status, but this does not automatically oblige another county to accept the person as being US resident, and it is possible for someone to be a resident of two countries when applying the rules of each country separately. In order to obtain a form 6166 Residency Certificate the teacher must complete form 8802 for which the IRS produces sixteen pages of instructions, of which page 4 relates to Dual Residency:

PAGE 4 is reproduced below with the Penalties of Perjury instructions.

All Double Taxation Agreements contain a Residency article, usually Article 4 , which includes a tie-breaker at paragraph 2:

"2. Where by reason of the provisions of paragraph 1, an individual is a resident of both

Contracting States, then his status shall be determined as follows:

In 2012 the Tax Court of Canada considered the case of a Mr Trieste, an American citizen

who had lived in Canada for 330 days in the year, and the US for 35, and who considered

himself to be a US resident by virtue of the Physical Presence Test. This case is reproduced

via the link below, on pages six to sixteen, and it should be observed that Mr Trieste was found to be a Canadian resident

under the tie-breaker provision on the grounds that Mr Trieste "spent a lot more time in Canada,

did not work elsewhere during that period, and in the settled routine of his life, regularly

and customarily lived in Canada while periodically returning to the US".

This statement could just as easily apply to any international teacher as it did to Mr. Trieste

and in such circumstances an American teacher who lived in Canada immediately before

visiting Thailand for the purposes of teaching should be considered to have been resident

in Canada and not the US, immediately before visiting Thailand. This is especially relevant

since the Canada-Thailand Double Taxation Agreement does not contain a reciprocal

tax exemption for teachers.

The same principles apply worldwide, and teachers who lived in countries other than the US for 183 days or more in the year

immediately before visiting Thailand would be deemed resident in that other country, not the US. In signing the Penalties of Perjury statement, declaring that a person was a US resident immediately before entering Thailand, that person is declaring they meet the conditions of both the Substantial Presence Test and the Article 4 tiebreaker, which taken together require that the teacher was physically present in the US for a minimum of 31 days and was not physically present in another country for 183 days in the preceding twelve months.